Scope and Objectives

The American Rescue Plan Act of 2021 provided $9.961 billion for Homeowner Assistance Funds (HAF), managed by the US Treasury, to reduce financial hardships associated with the coronavirus pandemic. SafeRock’s client was given a significant portion of these funds to eliminate homeowner mortgage delinquencies, defaults and foreclosures in the State.

The focused role for SafeRock was to provide an audit layer to the Treasury-approved program, improve compliance and ensure that money went to those residents who truly qualified for the help. SafeRock had to apply unique methods to quickly detect instances of fraud, waste, and abuse. SafeRock decided to add a sophisticated analytics-driven layer to the QA work being done by the State that strengthened the work of the team and supported its fiduciary goals. Towards this end, SafeRock analyzed social vulnerability and ESG impact at the county and state level; this improved community outreach, governance, and ensured equitable relief for applicants.

SafeRock wanted to enhance five areas:

To highlight the importance of this project, the State had lost billions of dollars to fraudulent claims during COVID, and ineligible applications were a major problem for a range of support services provided by the State including housing assistance, rent relief, and unemployment support, just to name a few.

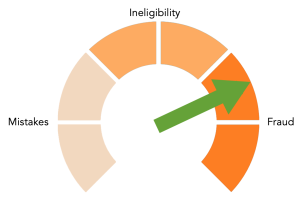

Fig.1 SafeRock’s Eligibility Wheel

The figure above shows the range of ineligible applications uncovered during the project. These included inadvertent mistakes, represented by the left side of SafeRock’s Eligibility Wheel. The middle portion of the wheel represents applicants who might have misinterpreted application criteria and simply did not qualify as eligible applicants. On the far right of the SafeRock’s Eligibility Wheel are those applicants who applied with the intention of defrauding the State. Forged financial statements, forged bank statements, and pay slips were being used to defraud the State and this theft of taxpayer dollars had to be stopped.

SafeRock applied its proprietary Artificial Intelligence and Machine Learning algorithms to all five objectives noted above. The result was to see that government funds went to eligible applicants, while ensuring that applicants who made honest mistakes weren’t overlooked.

Timeline and Approach

The initial approach was to evaluate the supplied applicant information for the risk of negligence and fraud. This was expanded early on to examine the work by the client’s Eligibility Review to approve/deny decisions, and to improve the workflow and processes of the government entity.

Methods, Tools, and Data Sources

In terms of methods, SafeRock applied its own proprietary technology and algorithms to the analysis of the application forms. The tools included a variety of data science techniques, from Exploratory Data Analysis (EDA) to multivariate modeling, to SafeRock’s advanced algorithms for outlier and anomaly detection. ROI metrics and KPI measures were driven by Machine Learning and Artificial Intelligence methods including Neural Networks.

Observations

The original Eligibility Review workflow by the client was intensely manual and slowed down both the approval/denial, Eligibility review, and related QA processes. This made it difficult for the State to keep up with the pace of mortgage relief applications. The process should be automated.

Due to sheer volume and other considerations, the current Eligibility Review teams faced challenges in verifying that the mission at the heart of the program were being met.

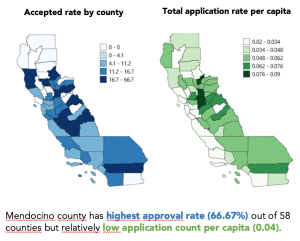

Fig. 2 Graphic showing accepted rate by county and total application rate per capita

As the figure above shows, there is a great disparity between accepted rate by county and total application rate per capita. The original set up of the Eligibility Review process did not evaluate this discrepancy in a meaningful way, a problem that SafeRock’s Rapid Approval Process (RAP) is able to rectify.

Outcomes

SafeRock’s analysis indicated that Governance goals for the mortgage relief program were at risk of not being met, such as with the wide variance of reviewer ratings, banks, geographies, and minorities. This implied that State’s fiduciary responsibilities may not be met and that disadvantaged groups were not receiving equitable relief.

The QA process was strengthened through analytics to regularly monitor and measure current performance. The Eligibility determination process and workflow related to foreclosure relief awards were significantly improved. This resulted in reduced costs and reduced waste for the US government, with better outcomes as well as greater efficiency for the client.

Project Details

Client: Government Entity

Focus: Reduce Fraud, Waste, and Abuse. Improve Compliance.