Ensuring a sustainable net-zero future

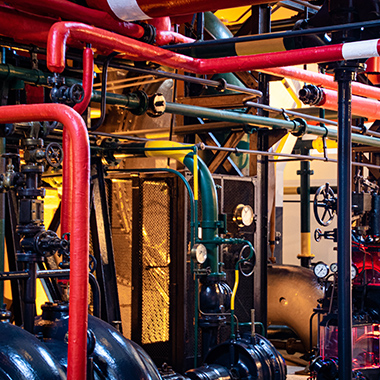

Reliable, risk-free, and clean

The energy sector faces a complex set of challenges, including the long anticipated energy transition from fossil fuels to renewables, changing financial sponsors on the boards of global energy companies, increase in electric batteries and technology driving EV and autonomous mobility. These and other disruptions such as volatile price swings in oil and gas markets mean there are multiple ways and opportunities for value creation.

Our mission is to help the industry prepare for the future. This incorporates the energy transition. It includes digital transformation. It requires attending to corporate social responsibility. All these have to be balanced in the context of shareholder and stakeholder needs, as well as compliance requirements. SafeRock can help you leverage your company’s strengths and strategic value drivers to enact positive change.

For companies that can adapt quickly, revolutions are a chance to claim technology leadership or reclaim lost ground. We cut through the clutter and can show you exactly where to focus to align your strategy with the market and turn technological opportunities into long-term shareholder value. We would be glad to set up a time to discuss these considerations in a confidential setting.

Our ‘Digital Twin’ simulator optimizes E&P value of land

Opportunities

Energy companies need to reduce their risk and complexity in downstream processing, R&D for core E&P and downstream petrochemical industries, as well as supply chain resilience for global shipping, transportation logistics, costs, and inventory management to assure customer delivery and minimize price volatility. SafeRock understands the need of companies to sustain cash flow on a steady basis, and to ensure their counter-cyclical product portfolio, and minimize the business impact of market changes.

SafeRock offers a detailed understanding of industry combined with technical expertise from a broad network of subject matter experts and industry professionals. We have worked on multiple international projects and can provide you with the assistance you need to capitalize on emerging opportunities and create long-term value for your company, from top-management consulting and strategy development, to operational performance enhancement.

With SafeRock, challenges are transformed into opportunities to grow. We work with our clients to reduce risk, identify opportunities for growth, assess and improve S&OP and innovation processes, all while improving overall company value.

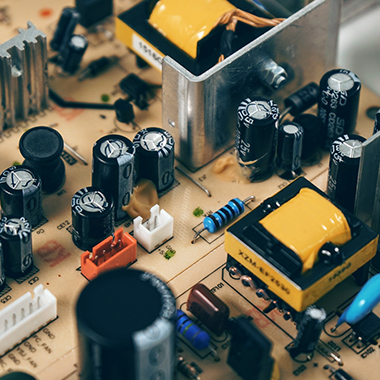

In light of COP26, industry 4.0 and advancements in digitization, automation, and eco-friendly technologies, high tech sectors and engineered products are surging forward. For example, additive manufacturing, Internet of Things, and M2M connections are all maturing technologies that promise to transform energy processing. Our successful track record is codified in analytics to improve productivity and enhance integration in the digital age with carbon neutrality as a key objective to achieve shortly. We have deep experience in the Energy sector and understand upstream and downstream activities, including:

- Exploration and Production

- Conversion and cracking

- Gathering and transfer

- Fracking

- Fuel Additives

- Pulp & Paper

- Paint and Coatings

- Metalworking Fluids

- Greases & Lubricants

- EV batteries and mobility

- Commodities and chemicals

- Construction & building products

- Feedstock and Agricultural Chemicals

What we provide: Our services and solutions

For the energy sector, SafeRock supports data-driven decisions with modeling, forecasting, and simulations for companies large and small. For instance, SafeRock has built a uniquely powerful predictive system for oil and gas fracking for extraction basins in Eagle Ford, Permian, and Bakken. This proprietary Big Data algorithm forecasted production for oil and gas wells with 74% greater accuracy than Wall Street analysts covering the company.

As an example, SafeRock improved oil and gas production forecast accuracy and improved anomaly and outlier identification for E&P companies that owned tens of thousands of oil and gas wells for basins in Texas, Oklahoma, Nebraska and other areas. These forecasts are hard to do because of the difficulty of forecasting productivity of a single oil well – output tends to swing around a lot, especially in fracking – due to unknown, new pockets of oil and gas that get released during E&P activity. SafeRock was able to further identify outliers for individual wells with great accuracy up to 30 days in advance of the company reporting this information, thus providing a significant advantage for the analysts covering this public corporation. SafeRock’s automated system combined anomaly detection with well productivity decline curves. This effectively improved on the industry-standard ARPS model, Estimated Ultimate Recovery (EUR) estimates, and production type curves for the business regions.

Our team understands the depth of your needs and works closely with your company to perform detailed analyses to jointly improve sales and operations, strengthen your innovation pipeline, and extend your financial runway. We focus on pragmatic solutions that increase shareholder value and market capitalization.

We can help company management to grow business value, improve strategic position, grow your leadership, deliver data-driven outcomes, and help you manage cash flow and business activity more effectively while balancing your customer goals.