Leverage opportunities to create value

Creating shareholder value

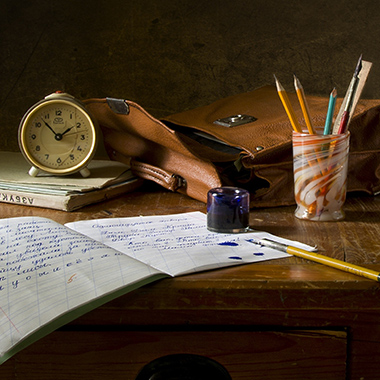

Among the many areas of potential benefit for investors, there are areas with outsized opportunities for private equity and alternative investors. The first area is that of megatrends, such as the meteoric rise of FANG companies (i.e., Facebook, Apple, Netflix, Google), that have accelerated through the pandemic – high touch is being replaced by frictionless. The second area is that of the misunderstood and unloved companies with cheap debt. These include real estate, certain B2B, industrial, infrastructure, and warehouses. A third area of outsized opportunity is with strong companies in strong sectors. Financial sponsors can consolidate a sector by buying a well-performing player and then acquiring others if and when they fall by the wayside. SafeRock can help financial sponsors in these three areas to create value.

We welcome discussing your portfolio companies and strategies on ESG, ecommerce and digital transformation. We can help reduce exit risk and focus on new revenue streams and emerging businesses. Contact us today to discuss how our analytics and strategy can help you face challenges and strengthen your portfolio.

Opportunities

With its limited investment horizon, private equity has to push and deliver financial ROI within the designated investment period. SafeRock’s goal is to deliver outsized value and reduce risk, and do this year after year. There is no time to rest on our laurels.

At the same time, there is no set formula for creating company value. You have to form a team that brings together creative, financial, operational and organizational experience. Dig deep, carefully but fearlessly.

Sometimes simple steps allow us to deliver outsize value and reduce risk. In a recent project for a multi-billion dollar corporate restructuring, we quickly noticed that basic blocking and tackling could go a long way. This led to clarity on the realistic options at hand for management.

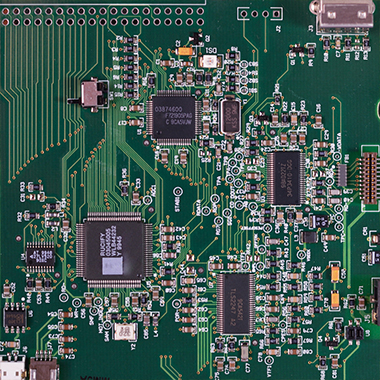

Every aspect of the business now faces disruption and challenges. Capital, leadership, and communications are important skills that PE firms provide. Harnessing this potential requires balancing ROI from online and offline transactions and driving higher sales, EBIT, and enterprise value. This can be enhanced with Artificial Intelligence, Machine Learning, and real-time analytics.

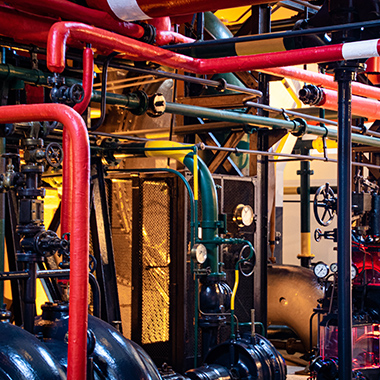

We are experts in managing such challenges and strengthening your company’s portfolio. Working with global leaders and technology, we support clients to find effective, deployable, and reliable solutions. We provide strategies that work, and we know how to improve, re-engineer, and restructure a business to best meet our clients’ financial, operational, and shareholder needs.

Both B2C and B2B environments are facing unprecedented disruptions from ecommerce and multi-channel shopping. Businesses have to successfully master how to engage customers over all channels and customer touchpoints. We can capture great growth opportunities when we apply our resources with purpose.

Each and every segment of operations now requires a reorientation. This goes from sourcing and supply chain, to category management and marketing, to ESG and risk management for executive teams and boards. Companies have to exploit new market opportunities while adjusting to the ecommerce-driven reality that modern customers expect – including immediate online transactions and swift same-day delivery where possible.

Online digital media marketing offers great opportunities to maintain your voice with the customer. Harnessing this potential requires balancing ROI online and offline and must be supported by Artificial Intelligence, Machine Learning, and real-time analytics combined with comprehensive after-the-fact reviews.

In this environment, best-in-class companies are:

- Capturing lost sales

- Integrating all sales channels

- Conducting a thorough post-mortem review

- Activating real-time marketing campaigns and tactics

- Deciding how to best partner with commerce platforms

We are experts in managing such challenges and strengthening your company’s competitive edge. Working with global leaders and technology, we support clients to find effective, deployable, and reliable solutions. We provide strategies that work, and we know how to improve, re-engineer, and restructure a business to best meet our clients’ financial, operational, and shareholder needs.

Market pressure is rising, and optimizing both top and bottom lines is mandatory. We need to move away from gut feelings and make data-driven decisions. The modern challenge is to use technology to strengthen your Sales and Operations and improve line of sight to the customer, reduce costs, and improve operational efficiency. These systems enable one-time data entry and improve transparency in your workflow to keep everyone on the same page. To optimize value, these should be integrated with your innovation pipeline, R&D, and intellectual property. The results are agile operations that decrease costs and increase bottom line EBIT, while at the same time protecting financial efficiency and driving entry into future markets.

We have focused experience with product categories including:

- Apparel

- Luxury

- Durables

- Furniture

- Hardware

- Automotive

- Food & beverage

- Household goods

- Beauty/cosmetics

- Convenience goods

- Consumer electronics

Our clients utilize multiple transaction platforms, including:

- Mobile

- E-commerce platforms

- Physical and online stores

- Direct to consumer (DTC)

What we provide: Our services and solutions

From innovation portfolios to supply chain planning and customer line-of-sight, we have successfully guided top-tier clients to leverage new market opportunities and gain competitive advantage. Together, we can improve your bottom line profits and top line sales.

Working together, we can:

- Protect exit value

- Curate portfolio value

- Strengthen strategic partnerships

- Look around the corner and help reduce risk

Whether it is digital transformation, lean operations, or supply chain resilience, let’s explore this together. We are happy to share our operational experience and ways to reduce company risk. We work with you and guide you to grow business value, improve strategic position, strengthen leadership, deliver data-driven outcomes, and use analytics to improve results and EBIT.

We strengthen your key trading partnerships, sharpen promotion decisions and increase marketing ROI, and recapture excess fat from S&OP, add resilience to supply chain, extend your financial runway, and improve shareholder value.